CEO Compensation: An Issue of Fairness or Evidence of a Functioning Free Market?

February 10, 2023 by

There is currently a bill in Congress, S.794 – Tax Excessive CEO Pay Act of 2021, that would increase taxes on companies on the basis of their CEO-to-worker compensation ratio. The legislation, introduced by Senator Bernie Sanders (I-Vt.) and cosponsored by a host of Democrats including Senator Elizabeth Warren (D-Mass.), has progressed to the Senate Committee on Finance but faces an extremely polarized Congress.

In the proposal, a ratio is ascribed to a company by dividing the CEO’s compensation by that of the median employee.1 The tax hike proposed in the Tax Excessive CEO Pay Act is gradually increased in proportion to the ratio, starting with a 0.5 percentage point increase for companies that pay their chief executive between 50 to 100 times more than their median worker. The highest tax applied is a five percentage point increase for corporations in which the CEO makes more than 500 times the typical employee. These percentage points would be added to the current corporate income tax rate of 21 percent.1

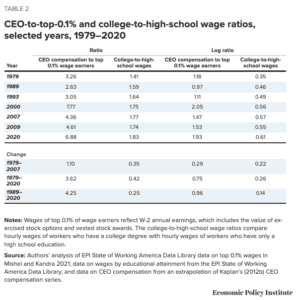

Compensation ratios vary greatly depending on specific organizations. Coca-Cola’s ratio, for example, is on the high end of the spectrum at 1,621 to 1.2. Of the top 1,000 firms, around 80 percent would be subject to higher taxes because of pay disparity.2 However, compensation can sometimes be difficult to calculate, with many CEOs receiving stock options and other forms of payment. Using data from the top 350 firms, the Economic Policy Institute (EPI) found the CEO-to-worker pay ratio to be 399 to 1 in 2021.3 This is an increase from 20 to 1 in 1965 and 58 to 1 in 1989.4 Some scholars credit this trend as contributing to growing wealth inequality in the United States. The EPI study found that from 1978 to 2019, CEO compensation expanded by 940 percent while median worker compensation grew by only 12 percent.3 The nearby chart illustrates the incongruent growth.

Arguments for the Tax Excessive CEO Pay Act

Arguing in support of the legislation, Senator Warren said, “We need to take dramatic steps to address wealth inequality in this country and discouraging massive executive payouts is a good place to start.” She added, “Corporate executives have padded their pockets while American workers, who helped generate record corporate profits, have hardly seen their wages budge.” Senator Sanders also views the current CEO-worker dynamic as inequitable and believes it is time for corporations to “pay their fair share.”5

Others argue that even if the tax does not incentivize companies to lessen the gap between CEO and worker compensation, the tax could still generate revenue that could be reinvested. A similar, but less extensive, tax in Portland, Oregon, generated $5.2 million in 2019. On a federal scale, the revenue could be used to tackle any number of issues facing America.

Arguments Against the Tax Excessive CEO Pay Act

Opponents argue that in cities like Portland that have experimented with similar taxes, the policy has not led to a dramatic lessening of CEO compensation.6 In fact, detractors insist that instead of reducing CEO pay, the policy would lead corporations to pass this new tax burden onto workers (in the form of lower wages) and consumers (in the form of higher prices).7 This ultimately hurts lower-income individuals the most.8 Others argue that the Tax Excessive CEO Pay Act would disproportionately harm specific sectors of the economy. Industries such as retail and fast food tend to rely on lower-skilled labor and could be affected more than specialized industries. Opponents worry that this disproportionate targeting could disrupt the fair and normal functioning of the economy and the global competitiveness of U.S. companies.

Discussion Questions

- Is wealth inequality an important issue for Congress to act on? Is it an important issue in your community?

- Is CEO-to-worker compensation in the United States a national issue the federal government should be involved in? Why or why not?

- Is the proposed legislation an effective method for reducing the disparities in CEO-to-worker compensation? Would you propose a different approach?

- What economic effects might the legislation produce?

Related Posts

Addressing Economic Inequality: Elizabeth Warren’s Wealth Tax Proposal

As always, we encourage you to join the discussion with your comments or questions below.

Sources

Featured Image Credit: Jose Luis Magana/AP

[1] https://www.congress.gov/bill/117th-congress/senate-bill/794/text?r=74

[2] https://www.bloomberg.com/graphics/ceo-pay-ratio/index.html

[3] https://www.epi.org/publication/ceo-pay-in-2021/

[4] https://www.thestand.org/2022/10/ceo-to-worker-pay-ratio-hits-all-time-high/

[5] https://www.sanders.senate.gov/press-releases/news-sanders-and-colleagues-introduce-legislation-to-combat-corporate-greed-and-end-outrageous-ceo-pay/

[6] https://www.oregonlive.com/business/2022/08/ceo-pay-keeps-soaring-defying-congress-and-local-taxes-see-which-executives-top-the-list-in-oregon.html#:~:text=Outsize%20pay%20packages%20remained%20abundant,package%20valued%20at%20%24179%20million.

[7] https://taxfoundation.org/bernie-sanders-ceo-pay-tax/

[8] https://www.forbes.com/sites/johngoodman/2021/04/02/who-pays-the-corporate-income-tax/?sh=e195dac58abe