Addressing Economic Inequality: Elizabeth Warren’s Wealth Tax Proposal

March 4, 2021

During her 2020 presidential bid, Senator Elizabeth Warren, D-Mass., put forward a tax on the wealthiest Americans—a so-called ultra-millionaire tax—as one of her central proposals.1 And on March 1, 2021, Warren introduced the Ultra-Millionaire Tax Act, which would “create an annual tax of 2 percent on the net worth of households and trusts between $50 million and $1 billion and a tax of 3 percent on net worth above $1 billion. The rate for net worth above $1 billion would increase to 6 percent if a ‘Medicare for All’ health care plan is enacted.”2

During her 2020 presidential bid, Senator Elizabeth Warren, D-Mass., put forward a tax on the wealthiest Americans—a so-called ultra-millionaire tax—as one of her central proposals.1 And on March 1, 2021, Warren introduced the Ultra-Millionaire Tax Act, which would “create an annual tax of 2 percent on the net worth of households and trusts between $50 million and $1 billion and a tax of 3 percent on net worth above $1 billion. The rate for net worth above $1 billion would increase to 6 percent if a ‘Medicare for All’ health care plan is enacted.”2

WATCH: Warren Argues for a Wealth Tax during a Democratic Primary Debate

A wealth tax would be a new form of taxation in the United States. The federal government currently taxes income, which is the money that people earn each year from their jobs and investments. Many states tax the value of a person’s real estate, which is a form of a wealth tax, but there is no current tax on wealth. Other countries have implemented wealth taxes in the past,3 and the state of California is currently considering a wealth tax as well.4 Warren’s wealth tax proposal targets the riches Americans, likely impacting roughly 100,000 families, meaning that 99.9992 percent of Americans would not be taxed.

READ: “The Wealth Tax is Going Global,” from Bloomberg News

Arguments for the Wealth Tax

- Projections suggest that the wealth tax could raise significant government revenue, as much as $3 trillion over ten years, allowing the government to fund programs aimed at reducing poverty.

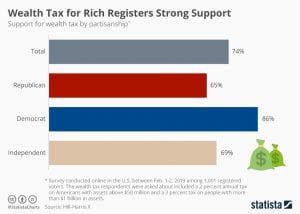

- “A wealth tax is popular among voters on both sides for good reason: because they understand the system is rigged to benefit the wealthy and large corporations,” said Warren. “As Congress develops additional plans to help our economy, the wealth tax should be at the top of the list to help pay for these plans because of the huge amounts of revenue it would generate.”6

- “The Ultra-Millionaire Tax Act will help level the playing field, narrow the racial wealth gap, ensure the wealthiest finally begin to pay their fair share, and invest trillions of dollars into our communities so we can make a real difference in the lives of people across America,” said Representative Pramila Jayapal, D-Wash., who introduced the same bill in the House of Representatives.7

- “As working families struggle to put food on the table, keep the heat on, and pay the rent during this devastating economic crisis that has caused the poverty rate to jump by the largest amount in at least 60 years, the rich have only gotten richer and the wealth of billionaires has jumped by 40%,” said Jayapal.8

Arguments Against the Wealth Tax

- The Manhattan Institute, a conservative think tank, argues in an issue brief that wealth taxes are inefficient and ineffective, as wealth is difficult to measure and can be effectively hidden through accounting strategies.9

- Over the past several decades, 12 European nations have experimented with wealth taxes. But nine of those countries abandoned the tax because it was expensive to enforce, it encouraged wealthy people (who invest in businesses and help create jobs) to leave the country or move their money, and it did not raise much revenue.10

- Some economists argue that a wealth tax is harmful to the economy because it slows economic growth, it changes the investment and purchasing patterns of the wealthy, and it discourages saving. This leads to less investment in new business ventures and innovation, thus slowing job creation and harming everyday Americans.11

- Other opponents believe that a wealth tax does little more than punish success and stoke class warfare. They argue that the government does not have a revenue problem; it has a spending problem that it must rein in.

Discussion Questions

- Do you believe wealth inequality is a problem in the United States? Why or why not?

- Do you think the federal government should take steps to reduce wealth inequality? Why or why not?

- Do you think a wealth tax is a good or bad proposal?

- If you were writing a letter to your representative or one of your senators, how would you urge them to vote? What would you say to convince them?

For a more detailed discussion of a wealth tax, read our Controversial Issue in the News on the proposal.

Learn More

- READ: The Ultra-Millionaire Tax, from Warren’s campaign website

- LISTEN: “Could a Wealth Tax Work?” from NPR’s Planet Money

- READ: “Estimating the Economic Impact of a Wealth Tax,” from the Brookings Institution

- WATCH: Larry Kudlow, the former top economic adviser to President Donald Trump, weighs in on Warren’s proposed tax, from Fox Business

- LISTEN: “The Wealth Tax Debate,” from Forbes

- READ: “Elizabeth Warren’s Wealth Tax on the Super-Rich is the Wrong Solution to the Right Problem,” from Time

As always, we encourage you to join the discussion with your comments or questions below!

Sources

Featured Image Credit: Greg Nash; Pool/Getty Images

[1] NPR: https://www.npr.org/2019/12/05/782135614/how-would-a-wealth-tax-work

[2] The Hill: https://thehill.com/policy/finance/540968-warren-offers-bill-to-create-wealth-tax-on-net-worth-above-50-million?rl=1

[3] The Tax Foundation: https://taxfoundation.org/wealth-taxes-in-the-oecd/

[4] Forbes: https://www.forbes.com/sites/robertwood/2020/08/17/california-proposes-168-income-tax-rate-plus-4-wealth-tax/?sh=43ed431d19a6

[5] CNN: https://www.cnn.com/2021/03/01/politics/elizabeth-warren-wealth-tax/index.html

[6] Business Insider: https://www.businessinsider.com/elizabeth-warren-introduces-wealth-tax-bill-for-incomes-over-50m-2021-3

[8] The Hill: https://thehill.com/policy/finance/540968-warren-offers-bill-to-create-wealth-tax-on-net-worth-above-50-million?rl=1

[8] Business Insider: https://www.businessinsider.com/elizabeth-warren-introduces-wealth-tax-bill-for-incomes-over-50m-2021-3

[9] The Manhattan Institute: https://www.manhattan-institute.org/whats-wrong-with-a-wealth-tax

[10] NPR: https://www.npr.org/sections/money/2019/02/26/698057356/if-a-wealth-tax-is-such-a-good-idea-why-did-europe-kill-theirs

[11] The Manhattan Institute: https://www.manhattan-institute.org/whats-wrong-with-a-wealth-tax