Tariffs and Trade: The Potential Impact on the Economy

February 14, 2025 by

During his first administration, President Donald Trump made tariffs and trade a major part of his economic policy. As he campaigned for another term, he further emphasized how he would use tariffs and trade if reelected. His strategy of issuing tariffs would be used to create more manufacturing jobs for Americans, shrink both the federal deficit and the U.S. trade deficit, and lower food prices.1 During the campaign, then-Vice President Kamala Harris pushed back, saying that Trump’s strategy would have a negative impact on families and their income. She saw, for example, a 20 percent universal tariff by a Trump administration costing families nearly $4,000 per year.2 This debate came at a time when inflation and the cost of consumer goods were among the top issues on voters’ minds.

During his first administration, President Donald Trump made tariffs and trade a major part of his economic policy. As he campaigned for another term, he further emphasized how he would use tariffs and trade if reelected. His strategy of issuing tariffs would be used to create more manufacturing jobs for Americans, shrink both the federal deficit and the U.S. trade deficit, and lower food prices.1 During the campaign, then-Vice President Kamala Harris pushed back, saying that Trump’s strategy would have a negative impact on families and their income. She saw, for example, a 20 percent universal tariff by a Trump administration costing families nearly $4,000 per year.2 This debate came at a time when inflation and the cost of consumer goods were among the top issues on voters’ minds.

What Are Tariffs?

Tariffs are charged as a percentage of the price a buyer pays a foreign seller for a product or commodities. Tariffs are intended to protect and boost domestic industries and home-grown manufacturers when the price of imports increase. Or, they can be used to punish foreign countries for committing unfair trade practices.3

So, why does President Trump advocate for tariffs today? He has cited several reasons, including generating revenue for the United States; influencing the policies of, and wielding power over, rival countries; and evening out the balance between U.S. imports and exports. Earlier this year, the Commerce Department reported that the U.S. goods trade deficit in 2024 had reached a record $1.2 trillion. In other words, the United States imported $1.2 trillion more in goods than it exported. The report also showed that the United States ran record bilateral trade deficits with Mexico, Vietnam, India, Taiwan, South Korea, and the European Union (EU).

According to White House Senior Counselor for Trade and Manufacturing Peter Navarro, a central goal of President Trump’s trade policy is to reduce the trade deficit “to zero.” This month, Navarro blamed high levels of imports for millions of lost American jobs, thousands of factory closings, and social and health problems such as alcoholism and drug addiction.4

A Study on the Impact of Tariffs

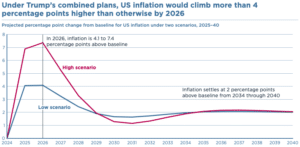

Last year, a study by the Peterson Institute for International Economics (PIIE) examined the impact of now-President Trump’s proposed tariffs.5 The major takeaways: lower national income, lower employment, and higher inflation. According to the study, the manufacturing and agriculture sectors would be most impacted.

Per PIIE: “We have no partisan goal in publishing this research. Our concerns are about the policies, not the candidate. Our objective is to educate policymakers and the public about the effects these measures would have on the U.S. and other economies.”6

PIIE predicted a 10 percent policy on all U.S. tariffs would increase inflation by 1.3 percent, and a 60 percent policy on imports from China would increase inflation by 0.7 percent.7

The Historical Context of Tariffs

From 1790 to 1860, approximately 90 percent of federal revenue came from tariffs.8 A federal income tax was created in 1913 to help generate revenue, and in 1945 the dependency on and use of tariffs decreased due to the need for larger revenue streams that tariffs alone couldn’t provide.9 The Trade Act of 1974 changed how presidents approached trade and tariffs with other countries for over 40 years, until President Trump.10 The law preauthorized removal of trade barriers on a reciprocal basis in negotiations with foreign countries, later renewed by subsequent administrations. Freer trade became a key part of Republican Party platforms for presidential candidates throughout this time period.

The State of Tariffs Today

In 2018, President Trump issued tariffs on steel and aluminum that caused the European Union to put tariffs on American whiskey, leading to exports of whiskey falling by 30 percent after a 25 percent tariff was issued.11 Those tariffs are set to expire in 2025. President Trump’s tariffs on China led to soybean exports dropping by 75 percent.12 He has proposed using tariffs on farm imports to lower the cost of food products, but some economists feel this would increase grocery prices and reduce consumer choice.13 These economists warn that foreign producers can pass along some or all of the tax burden on consumers in the form of higher prices.14 When the last fiscal year ended on September 30, tariffs and fees generated roughly one-third of the revenue of income taxes and roughly half of the revenue of Social Security and Medicare taxes.15

Now in the early days of his second term, President Trump has carried out his promise of 25 percent tariffs on goods from Canada and Mexico and 10 percent on goods from China. The Canada and Mexico tariffs have been paused for 30 days. The tariffs from China could impact over $450 billion worth of imports, and the Tax Foundation estimates they could add a $172 tax burden per household.16 China has responded with 15 percent tariffs on coal, natural gas, crude oil, and farm equipment. Tariffs on Canada and Mexico would impact produce such as tomatoes, strawberries, and avocados, as well as car and gas prices and construction materials like lumber.17 PIIE predicts that the combined tariffs would cost the median household over $1,200 a year.18 President Trump has also issued a 25 percent tariff on all steel and aluminum imports, which would impact Canada and Mexico the most.

Discussion Questions

- Should the United States increase tariffs on other countries to address economic concerns like inflation and the loss of U.S. jobs?

- How, if at all, might tariffs impact industries in your state and community?

- Should Congress have more authority to set tariff policies? Or do you think tariffs are an appropriate use of executive power?

- Which should be a greater priority when seeking to boost the economy: issuing tariffs or creating stronger trade agreements? Why?

As always, we encourage you to join the discussion with your comments or questions below.

Close Up is proud to be the nation’s leading nonprofit civic education organization, working with schools and districts across the country since 1971. If you would like to partner with us or learn more about our experiential learning programs, professional development, or curriculum design and consulting, contact us today!

Sources

Featured Image Credit: Costfoto/NurPhoto via Getty Images

[1] Economic Times: economictimes.indiatimes.com/news/international/world-news/us-election-2024-how-trumps-trade-war-could affect-everyday-americans-and-their-businesses

[2] PBS: https://www.pbs.org/newshour/economy/trump-favors-huge-new-tariffs-how-do-they-work

[3] PBS: https://www.pbs.org/newshour/economy/trump-favors-huge-new-tariffs-how-do-they-work

[4] Politico: https://www.politico.com/news/2025/02/05/trump-trade-deficit-2024-00202569

[5] PIIE: https://www.piie.com/blogs/realtime-economics/2024/how-much-would-trumps-plans-deportations-tariffs-and-fed-damage-us

[6] PIIE: https://www.piie.com/blogs/realtime-economics/2024/how-much-would-trumps-plans-deportations-tariffs-and-fed-damage-us

[7] PIIE: https://www.piie.com/blogs/realtime-economics/2024/how-much-would-trumps-plans-deportations-tariffs-and-fed-damage-us

[8] PBS: https://www.pbs.org/newshour/economy/trump-favors-huge-new-tariffs-how-do-they-work

[9] PBS: https://www.pbs.org/newshour/economy/trump-favors-huge-new-tariffs-how-do-they-work

[10] PIIE: https://www.piie.com/blogs/realtime-economics/2024/trumps-selective-celebration-president-mckinley

[11] Economic Times: economictimes.indiatimes.com/news/international/world-news/us-election-2024-how-trumps-trade-war-could affect-everyday-americans-and-their-businesses

[12] Economic Times: economictimes.indiatimes.com/news/international/world-news/us-election-2024-how-trumps-trade-war-could affect-everyday-americans-and-their-businesses

[13] Economic Times: economictimes.indiatimes.com/news/international/world-news/us-election-2024-how-trumps-trade-war-could affect-everyday-americans-and-their-businesses

[14] ABC News: https://abcnews.go.com/Business/harris-trump-debate-economists-assess-attacks-inflation-tariffs/story?id=113584629

[15] PBS: https://www.pbs.org/newshour/economy/trump-favors-huge-new-tariffs-how-do-they-work

[16] NPR: https://www.npr.org/2025/02/05/nx-s1-5284991/trump-tariffs-higher-prices-inflation-mexico-canada-china

[17] NPR: https://www.npr.org/2025/02/05/nx-s1-5284991/trump-tariffs-higher-prices-inflation-mexico-canada-china

[18] PIIE: https://www.piie.com/research/piie-charts/2025/trumps-tariffs-canada-mexico-and-china-would-cost-typical-us-household