Last month, Senators Jon Ossoff, D-Ga., and Mark Kelly, D-Ariz., introduced the Ban Congressional Stock Trading Act, a reform bill that would require members of Congress to divest their stock market investments or face fines totaling the entire amount of their congressional salary.1 So, should members of Congress be allowed to trade stocks?

Last month, Senators Jon Ossoff, D-Ga., and Mark Kelly, D-Ariz., introduced the Ban Congressional Stock Trading Act, a reform bill that would require members of Congress to divest their stock market investments or face fines totaling the entire amount of their congressional salary.1 So, should members of Congress be allowed to trade stocks?

According to an August 2021 Gallup poll, approximately 56 percent of U.S. adults own stock.2 Stocks, also called equities, are bought in units called “shares” and represent partial ownership of a company.3 Investors who own shares hope for a return on their investment; if the company they invest in succeeds, their stock price rises and increases in worth. Investors may receive dividend payments, which are earnings that the company issues to its stockholders.4 At least 220 members of Congress—more than 40 percent of senators and representatives—own stock. This has raised concerns about corruption and conflicts of interest, prompting the question: should members of Congress be allowed to trade stocks?

The Ban Congressional Stock Trading Act would “require all members of Congress, their spouses, and dependent children to place their stock portfolios into a blind trust.”5 A blind trust is a method of divesting assets in which stockholders pass their investments on to an independent third party which then makes financial decisions on their behalf, insulating the stockholders from day-to-day decision-making and trading.

A decade ago, Congress passed and President Barack Obama signed into law the Stop Trading on Congressional Knowledge (STOCK) Act, which aimed to prevent insider trading in Congress. Due to the nature of their job, members of Congress often have access to sensitive information from closed-door meetings and briefings about markets, upcoming regulations, and a multitude of government issues. They’re also the ones in charge of creating federal policy. The STOCK Act prohibits members of Congress from buying or selling stock on the basis of any privileged information they receive. It also requires Congress members trading stocks to be publicly disclosed on searchable, online databases within 45 days.6

Although the STOCK Act was an example of Congress taking the initiative to reform itself, the results have not been as effective as hoped. The average fine for failing to report trades on time is a mere $200, and according to an investigative series by Business Insider, 55 members of Congress—Democrats and Republicans alike—were late in disclosing their stock trades.7 Some were late by only a few days; others were late by months.8

READ MORE: “These Are the 50 Top Stocks that Members of Congress Own”

In January 2020, before the general public was aware of the severity of the COVID-19 pandemic, Senator Kelly Loeffler, R-Ga., sold millions of dollars of stock in companies that were poised to be hit hard by the pandemic, right before they dropped in value.9 She then purchased stock “in a company that makes COVID-19 protective garments.”10 Around the same time, financial decisions by Senators David Perdue, R-Ga., Richard Burr, R-N.C., and Dianne Feinstein, D-Calif., also received scrutiny for what looked like insider trading. They have all denied any wrongdoing, and investigations by the U.S. Department of Justice have since concluded without any recommended charges.11

While there has been talk on Capitol Hill about doing more to rein in the buying and selling of stocks, and subsequent insider trading, by senators and representatives, leadership in the Democrat-controlled House of Representatives and Senate initially pushed back against the idea. “We are a free-market economy,” said Speaker of the House Nancy Pelosi, D-Calif., who owns and trades stock along with members of her immediate family, adding that members of Congress “should be able to participate in this.”12 Just last week, Senate Majority Leader Chuck Schumer, D-N.Y., signaled his support for discussing details of the proposal, warming up to it after facing bipartisan pressure from his fellow lawmakers.13

But it’s not just bipartisan support among those in Congress. According to the conservative-leaning Convention of States Action, 76 percent of Americans agree that members of Congress have an “unfair advantage” in the stock market and should not be allowed to trade stocks while in office.14 Those who support the Ban Congressional Stock Trading Act believe that elected officials need to rebuild trust with the American people, increase transparency, and show that they will put the best interests of their constituents before any personal profit.

Those who oppose the Ban Congressional Stock Trading Act believe that members of Congress should be free to participate in the stock market like anyone else, regardless of their position or title. They note that the STOCK Act is already on the books and should be better enforced to prevent even the appearance of corruption.

Discussion Questions

- Do you believe elected officials should be held to higher standards and face more scrutiny than those who don’t hold public office? If so, in what ways?

- Should members of Congress be expected to give up some of their freedoms in order to serve in their positions?

- Do you have trust in your elected officials to put the interests of the people before their own? Why or why not?

- Are there any other ethics reforms that you think could build trust and increase transparency in Congress?

As always, we encourage you to join the discussion with your comments or questions below!

Sources

Featured Image Credit: POLITICO illustration/Getty and iStock

[1] Website of Senator Jon Ossoff: https://www.ossoff.senate.gov/press-releases/sens-ossoff-kelly-introduce-bill-banning-stock-trading-by-members-of-congress/

[2] Gallup: https://news.gallup.com/poll/266807/percentage-americans-owns-stock.aspx

[3] U.S. Securities and Exchange Commission: https://www.investor.gov/introduction-investing/investing-basics/investment-products/stocks

[4] Ibid.

[5] Website of Senator Jon Ossoff: https://www.ossoff.senate.gov/press-releases/sens-ossoff-kelly-introduce-bill-banning-stock-trading-by-members-of-congress/

[6] New York Times: https://www.nytimes.com/2022/01/24/briefing/congress-stock-investments-profits.html

[7] Business Insider: https://www.businessinsider.com/congress-stock-act-violations-senate-house-trading-2021-9#sen-rand-paul-a-republican-from-kentucky-4

[8] Ibid.

[9] Vox: https://www.vox.com/policy-and-politics/2020/4/1/21202900/kelly-loeffler-stock-sales-coronavirus-pandemic

[10] Atlanta Journal-Constitution: https://www.ajc.com/news/state–regional-govt–politics/loeffler-reports-more-stock-sales-amid-insider-trading-allegations/YFPDT3pChO873nuzNKa44K/

[11] Washington Post: https://www.washingtonpost.com/local/legal-issues/justice-dept-ends-coronavirus-insider-trading-investigations-into-us-sens-loeffler-inhofe-and-feinstein/2020/05/26/5e59b9a4-9f8b-11ea-b5c9-570a91917d8d_story.html

[12] New York Times: https://www.nytimes.com/2022/01/24/briefing/congress-stock-investments-profits.html

[13] Business Insider: https://www.businessinsider.com/senate-schumer-vote-banning-lawmakers-trading-stocks-ossoff-2022-2

[14] The Hill: https://thehill.com/homenews/news/588630-76-percent-of-voters-support-banning-lawmakers-from-trading-stocks-poll?rl=1

On February 4, the Republican National Committee (RNC) officially censured two members of the party, Representatives Liz Cheney, R-Wyo., and Adam Kinzinger, R-Ill., for their role in the ongoing House of Representatives investigation into the Capitol riot that occurred on January 6, 2021.

On February 4, the Republican National Committee (RNC) officially censured two members of the party, Representatives Liz Cheney, R-Wyo., and Adam Kinzinger, R-Ill., for their role in the ongoing House of Representatives investigation into the Capitol riot that occurred on January 6, 2021. President Joe Biden has ordered the Pentagon to put 8,500 U.S. troops on heightened alert for a possible deployment to Europe.1 And the State Department has told the families of U.S. diplomats in Ukraine to leave the country as the possibility of a Russian invasion increases.2 So, what is the situation in Ukraine?

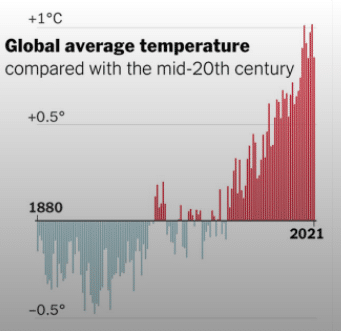

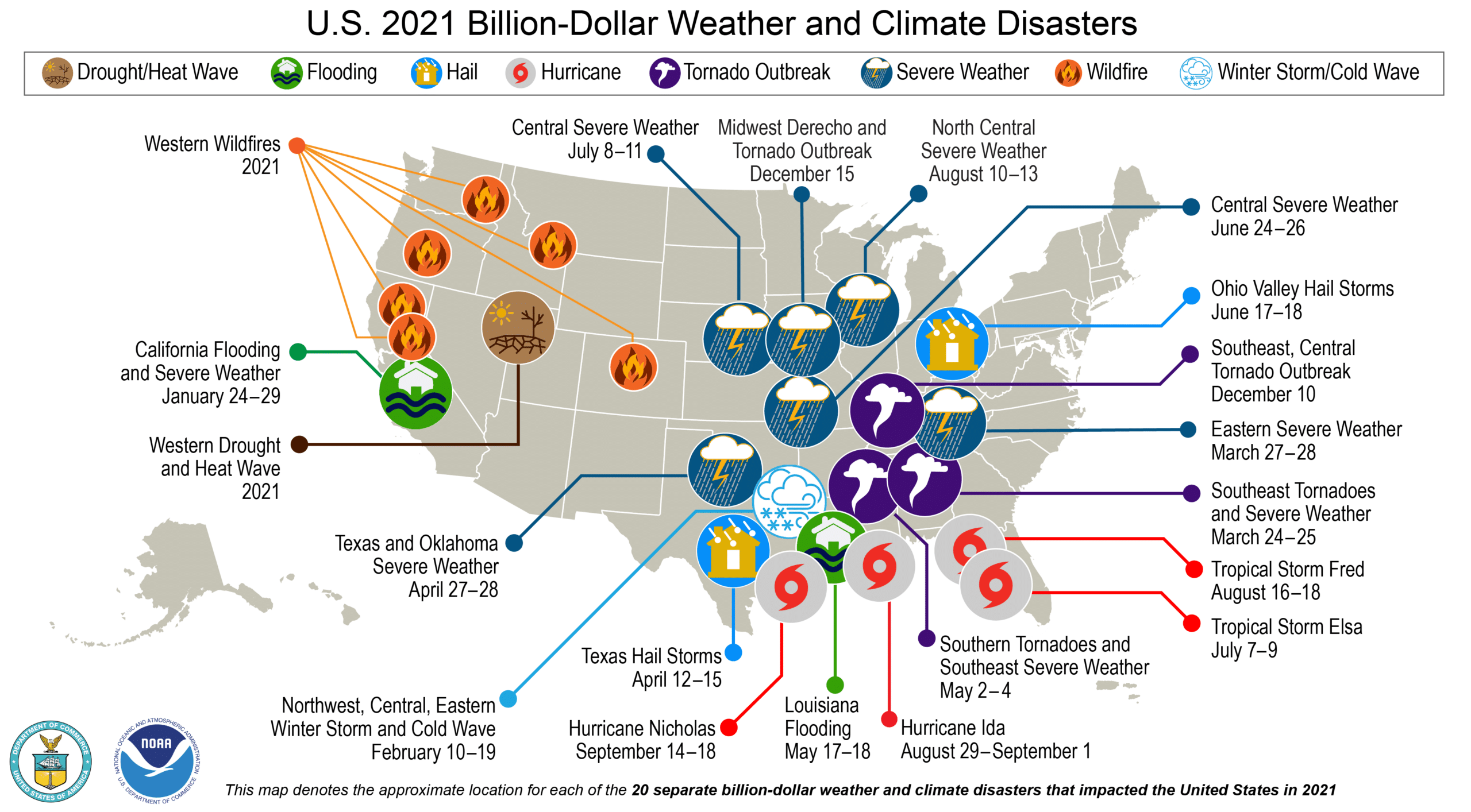

President Joe Biden has ordered the Pentagon to put 8,500 U.S. troops on heightened alert for a possible deployment to Europe.1 And the State Department has told the families of U.S. diplomats in Ukraine to leave the country as the possibility of a Russian invasion increases.2 So, what is the situation in Ukraine? It’s official: 2021 was either the fifth or sixth hottest year on record, depending on who you ask.

It’s official: 2021 was either the fifth or sixth hottest year on record, depending on who you ask. This is part of a broad trend of record-breaking temperatures. The previous seven years have been the seven hottest on record.5 And according to the NOAA, July 2021 was the single hottest month ever recorded.6 NOAA administrator Rick Spinrad characterized this data as a continuation of “the disturbing and disruptive path that climate change has set for the globe.”7

This is part of a broad trend of record-breaking temperatures. The previous seven years have been the seven hottest on record.5 And according to the NOAA, July 2021 was the single hottest month ever recorded.6 NOAA administrator Rick Spinrad characterized this data as a continuation of “the disturbing and disruptive path that climate change has set for the globe.”7

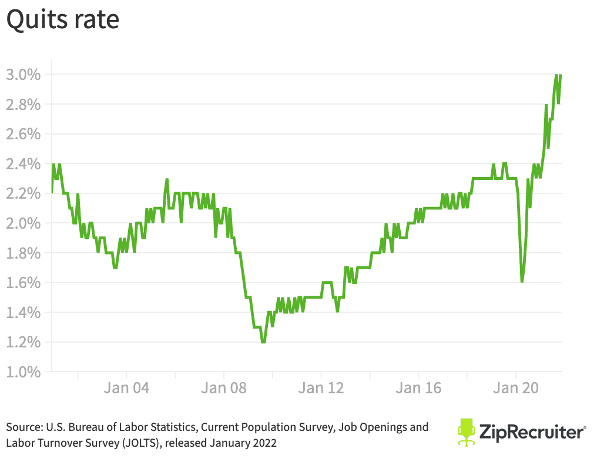

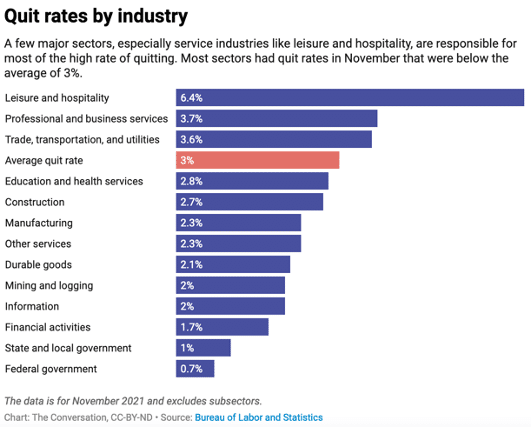

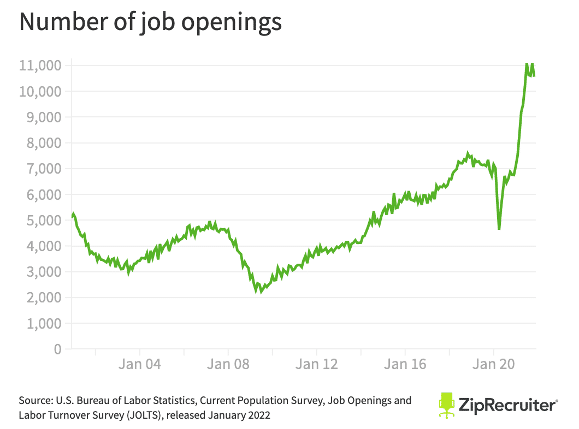

Across the United States, towns and cities are flooded with “Help Wanted” signs on business doors. The U.S. job market has seen its share of ups and downs over the last two years, but 2021 was a year of record-breaking highs in many categories. The two most important: record-breaking quits and record-breaking new job openings.

Across the United States, towns and cities are flooded with “Help Wanted” signs on business doors. The U.S. job market has seen its share of ups and downs over the last two years, but 2021 was a year of record-breaking highs in many categories. The two most important: record-breaking quits and record-breaking new job openings.

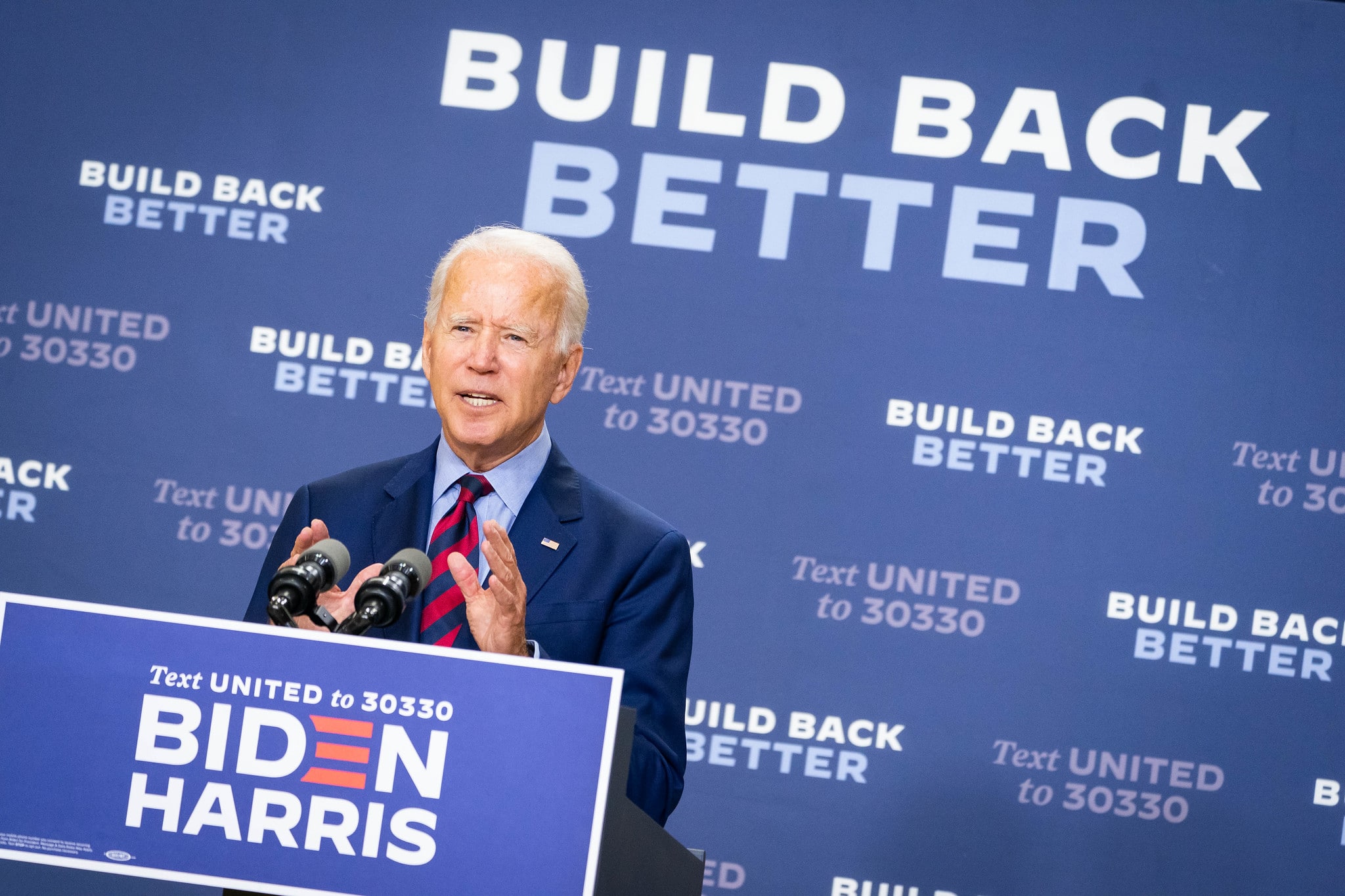

Already facing the enormous challenge of addressing spiking cases of COVID-19 due to the Omicron variant, President Joe Biden’s administration was presented with a new challenge when Senator Joe Manchin, D-W.Va., announced that he would not support the $2 trillion spending plan known as Build Back Better Bill. Citing concerns over the level of spending on social safety net programs and climate policies, Manchin said he could not find a way to support the bill that would be consistent with what he believes his constituents in West Virginia want.1

Already facing the enormous challenge of addressing spiking cases of COVID-19 due to the Omicron variant, President Joe Biden’s administration was presented with a new challenge when Senator Joe Manchin, D-W.Va., announced that he would not support the $2 trillion spending plan known as Build Back Better Bill. Citing concerns over the level of spending on social safety net programs and climate policies, Manchin said he could not find a way to support the bill that would be consistent with what he believes his constituents in West Virginia want.1 On November 26, 2021, the World Health Organization announced the discovery of a new COVID-19 variant in South Africa. The same day, President Joe Biden closed the borders to travelers from South Africa and seven nearby nations (Namibia, Botswana, Lesotho, Eswatini, Mozambique, Zimbabwe, and Malawi) in the hope of slowing the spread of the variant to the United States. In a speech to the American public on November 29, President Biden addressed the closing of the border, saying, “Closing the borders cannot prevent the spread, but … it gives us time to take more actions, to move quicker, for people to get the vaccine.”

On November 26, 2021, the World Health Organization announced the discovery of a new COVID-19 variant in South Africa. The same day, President Joe Biden closed the borders to travelers from South Africa and seven nearby nations (Namibia, Botswana, Lesotho, Eswatini, Mozambique, Zimbabwe, and Malawi) in the hope of slowing the spread of the variant to the United States. In a speech to the American public on November 29, President Biden addressed the closing of the border, saying, “Closing the borders cannot prevent the spread, but … it gives us time to take more actions, to move quicker, for people to get the vaccine.” On November 15th, President Biden signed the Infrastructure Investment and Jobs Act (IIJA). The bill represents the culmination of months of negotiations between House Democrats and Republicans as well as within the two parties. The goal of this US infrastructure bill is to significantly revitalize and modernize American infrastructure – the various systems, equipment, and structures that make modern life possible. Although significantly less than the original bill, the $1.2 trillion package represents one of the most significant investments by the federal government in infrastructure since the Great Depression.1

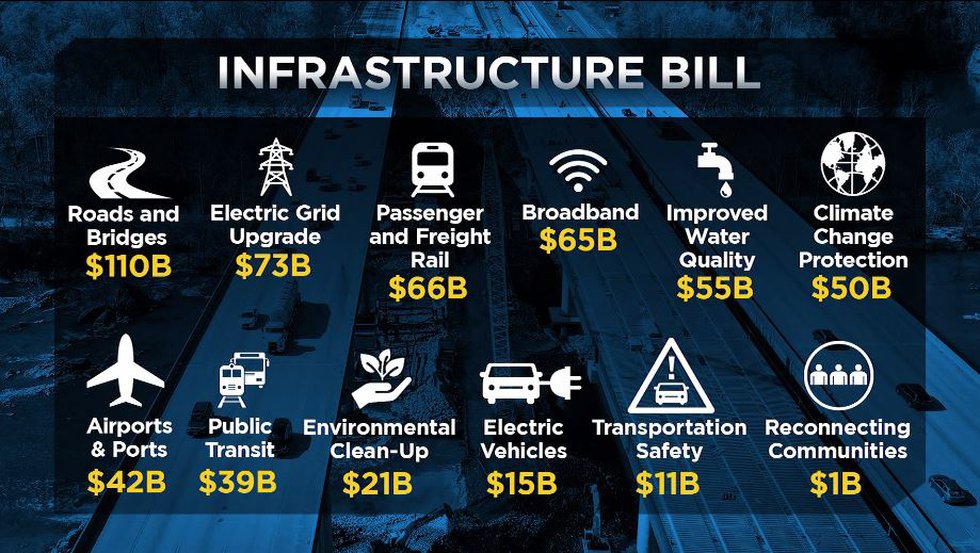

On November 15th, President Biden signed the Infrastructure Investment and Jobs Act (IIJA). The bill represents the culmination of months of negotiations between House Democrats and Republicans as well as within the two parties. The goal of this US infrastructure bill is to significantly revitalize and modernize American infrastructure – the various systems, equipment, and structures that make modern life possible. Although significantly less than the original bill, the $1.2 trillion package represents one of the most significant investments by the federal government in infrastructure since the Great Depression.1 In September 2021, a bipartisan group of senators and representatives reintroduced the Truth and Healing Commission on Indian Boarding School Policies in the United States Act, which would establish a commission to “investigate, document, and acknowledge past injustices of the federal government’s Indian Boarding School Policies.”1 The Truth and Healing Commission would use its findings to recommend actions to best redress the historical trauma and long-term impacts of those policies.

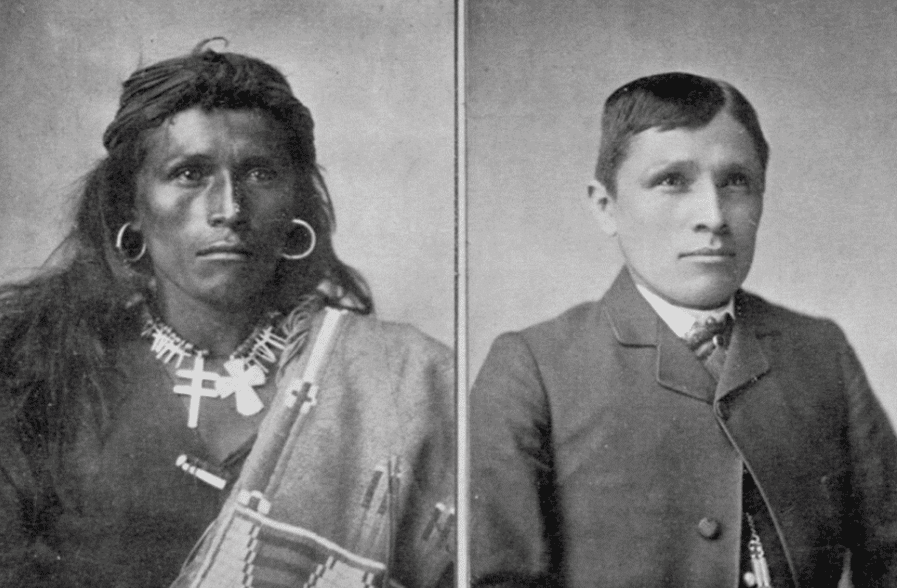

In September 2021, a bipartisan group of senators and representatives reintroduced the Truth and Healing Commission on Indian Boarding School Policies in the United States Act, which would establish a commission to “investigate, document, and acknowledge past injustices of the federal government’s Indian Boarding School Policies.”1 The Truth and Healing Commission would use its findings to recommend actions to best redress the historical trauma and long-term impacts of those policies. Part 2: The Current Debate Facing the U.S. Supreme Court

Part 2: The Current Debate Facing the U.S. Supreme Court