On January 20, his first day back in office, President Donald Trump issued an executive order that stops new offshore wind projects from obtaining lease permits, halting development meant to power over 12 million homes.1 At a rally later that day, President Trump characterized wind turbines as ugly and harmful to property values and to the environment.2

On January 20, his first day back in office, President Donald Trump issued an executive order that stops new offshore wind projects from obtaining lease permits, halting development meant to power over 12 million homes.1 At a rally later that day, President Trump characterized wind turbines as ugly and harmful to property values and to the environment.2

What is Offshore Wind?

Wind farms generate energy from natural winds that spin the blades of large wind turbines. Wind turbines offer a renewable alternative to the burning of fossil fuels such as oil and natural gas. Renewable energy (energy from Earth’s natural forces), unlike energy from burning fossil fuels, does not emit the greenhouse gases that are increasing global temperatures. Climate scientists and activists argue that replacing fossil fuels with renewable energy sources is necessary to limit climate change and future devastating effects on Earth.3 Wind farms built offshore, in the ocean or other large bodies of water, harness large amounts of wind energy from unobstructed coasts.

There are two main types of offshore wind turbines: floating turbines and fixed-bottom turbines. They differ in how they are attached to the ocean floor. Cables secure floating turbines, while fixed-bottom turbines are built directly on the ocean floor. Fixed-bottom turbines are the most common—they are easier and cheaper to install—but they can only be built in shallow water.4 The United States has an estimated 1.5 terawatts (equal to 1,500 gigawatts) of fixed-bottom offshore wind potential—enough energy to power the entire country.5

Currently, there are only three fully operational offshore wind farms in the United States. The 132-megawatt South Fork Wind Farm is the newest offshore wind farm and operates off the coast of Long Island, New York. Completed in December 2023, this project was the first commercial-scale wind farm in the country.6 Generating more offshore wind infrastructure could significantly decrease American dependence on fossil fuels and reduce energy costs, but new projects require a large amount of money to fund construction as well as approval and guidance from multiple government agencies. Elected officials now must decide: should the government support more offshore wind projects?

The Debate Over Offshore Wind

Supporters of offshore wind note that one of its major benefits is its capacity to generate large amounts of energy, compared to less efficient forms of renewable energy like onshore wind farms. Because wind is stronger and more consistent over bodies of water, offshore turbines can generate twice as much energy as those on land.7 Offshore wind farms are typically built several miles off the coast and are minimally visible from shore. Additionally, coasts have fewer obstructions and building limitations, a problem that wind farms on land commonly face. Furthermore, investment in offshore wind creates jobs and economic growth in local communities because workers are needed to maintain turbines and connect wind farms to the rest of the electric grid. Finally, higher offshore wind capacity can contribute to greater energy independence by increasing the amount of energy produced in the United States and thereby reducing America’s reliance on foreign sources of energy.8

Opponents, however, believe the benefits of offshore wind are outweighed by costs and environmental disruption.9 For offshore wind to be viable, policy leaders must grant developers more money and change regulations at all levels of government. The approval process can take years of negotiating with communities, government agencies, and other industries, such as the fishing industry, which can lead to costly delays. Additionally, constructing offshore turbines, especially drilling for fixed-bottom models, threatens vulnerable ecosystems.10 Finally, coastal communities frequently oppose any changes to treasured shoreline views. For example, the Vineyard Wind project off the coast of Martha’s Vineyard, Massachusetts, faced significant opposition from residents who were concerned about turbines interrupting the natural coastline view surrounding the island.12

Many policymakers and voters agree on a need to transition away from fossil fuels, but the federal government has yet to develop a unified set of policy actions. Offshore wind offers an opportunity to generate large amounts of renewable energy, but Americans must decide if its potential is worth the significant advocacy and investment it requires.

Discussion Questions

- What factors should the government consider when deciding to approve or deny offshore wind projects? Which factors are the most important in this decision? Why are they important?

- Why might some people prioritize preserving ocean views over increasing renewable energy infrastructure?

- How much disruption or damage to ocean ecosystems, if any, is acceptable in order to construct renewable energy projects?

- How should the opinions of local residents shape plans for renewable energy projects?

As always, we encourage you to join the discussion with your comments or questions below.

Close Up is proud to be the nation’s leading nonprofit civic education organization, working with schools and districts across the country since 1971. If you would like to partner with us or learn more about our experiential learning programs, professional development, or curriculum design and consulting, contact us today!

Sources

Featured Image Credit: CERTREC

[1] CNBC: https://www.cnbc.com/2025/02/16/trumps-broadside-against-wind-industry-puts-projects-that-could-power-millions-of-homes-at-risk.html

[2] FactCheck.org: https://www.factcheck.org/2025/02/what-to-know-about-trumps-executive-order-on-wind-energy/

[3] Intergovernmental Panel on Climate Change: https://www.ipcc.ch/sr15/chapter/spm/

[4] National Renewable Energy Laboratory: https://www.nrel.gov/wind/fixed-bottom-offshore-webinar.html

[5] Bipartisan Policy Center: https://bipartisanpolicy.org/blog/the-latest-headwinds-and-tailwinds-for-u-s-offshore-wind/

[6] Department of Energy: https://www.energy.gov/eere/wind/articles/top-10-things-you-didnt-know-about-offshore-wind-energy

[7] The Renewable Energy Hub: https://www.renewableenergyhub.co.uk/blog/pros-and-cons-of-offshore-energy

[8] World Economic Forum: https://www.weforum.org/agenda/2022/11/offshore-wind-farms-future-renewables/

[9] The Renewable Energy Hub: https://www.renewableenergyhub.co.uk/blog/pros-and-cons-of-offshore-energy

[10] The Renewable Energy Hub: https://www.renewableenergyhub.co.uk/blog/pros-and-cons-of-offshore-energy

[11] The Providence Journal: https://www.providencejournal.com/story/news/local/2021/08/26/vineyard-wind-power-project-sued-over-impact-whales/5600298001/

On his first day back in office, President Donald Trump signed an executive order that implemented a 90-day freeze on aid to other countries. Since then, the offices of the U.S. Agency for International Development (USAID) have closed, staff have been furloughed, and there have been more funding freezes. The formerly semi-autonomous agency is now under the leadership of Secretary of State Marco Rubio. Tech billionaire Elon Musk, who leads the new advisory body called the Department of Government Efficiency (DOGE), has targeted USAID and foreign aid when advocating for cutting the federal budget.

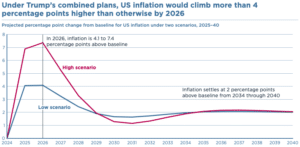

On his first day back in office, President Donald Trump signed an executive order that implemented a 90-day freeze on aid to other countries. Since then, the offices of the U.S. Agency for International Development (USAID) have closed, staff have been furloughed, and there have been more funding freezes. The formerly semi-autonomous agency is now under the leadership of Secretary of State Marco Rubio. Tech billionaire Elon Musk, who leads the new advisory body called the Department of Government Efficiency (DOGE), has targeted USAID and foreign aid when advocating for cutting the federal budget. During his first administration, President Donald Trump made tariffs and trade a major part of his economic policy. As he campaigned for another term, he further emphasized how he would use tariffs and trade if reelected. His strategy of issuing tariffs would be used to create more manufacturing jobs for Americans, shrink both the federal deficit and the U.S. trade deficit, and lower food prices.1 During the campaign, then-Vice President Kamala Harris pushed back, saying that Trump’s strategy would have a negative impact on families and their income. She saw, for example, a 20 percent universal tariff by a Trump administration costing families nearly $4,000 per year.2 This debate came at a time when inflation and the cost of consumer goods were among the top issues on voters’ minds.

During his first administration, President Donald Trump made tariffs and trade a major part of his economic policy. As he campaigned for another term, he further emphasized how he would use tariffs and trade if reelected. His strategy of issuing tariffs would be used to create more manufacturing jobs for Americans, shrink both the federal deficit and the U.S. trade deficit, and lower food prices.1 During the campaign, then-Vice President Kamala Harris pushed back, saying that Trump’s strategy would have a negative impact on families and their income. She saw, for example, a 20 percent universal tariff by a Trump administration costing families nearly $4,000 per year.2 This debate came at a time when inflation and the cost of consumer goods were among the top issues on voters’ minds.

TOWNSEND — Superintendent Brad Morgan and Principal Laurie Smith are pleased to announce that North Middlesex Regional High School senior Adam Manni has been selected to participate in the Close Up Washington: Johnson & Johnson Scholarship Program.

TOWNSEND — Superintendent Brad Morgan and Principal Laurie Smith are pleased to announce that North Middlesex Regional High School senior Adam Manni has been selected to participate in the Close Up Washington: Johnson & Johnson Scholarship Program. Washington, D.C. was the spot, as 32 students and three teachers from McIntosh High got hands-on for a week of sightseeing and civic engagement workshops through the “Close Up Foundation.”

Washington, D.C. was the spot, as 32 students and three teachers from McIntosh High got hands-on for a week of sightseeing and civic engagement workshops through the “Close Up Foundation.” In January 2025, twelve students from Northwest Indiana had the unique opportunity to participate in a weeklong government studies program in Washington D.C. through the ECIER Foundation. This unforgettable trip was part of a partnership with the Close Up Foundation, which is dedicated to providing high school students with an in-depth, hands-on learning experience about the U.S. government. The students, representing several schools in the region, were able to engage with peers from across the country and witness firsthand the workings of American democracy.

In January 2025, twelve students from Northwest Indiana had the unique opportunity to participate in a weeklong government studies program in Washington D.C. through the ECIER Foundation. This unforgettable trip was part of a partnership with the Close Up Foundation, which is dedicated to providing high school students with an in-depth, hands-on learning experience about the U.S. government. The students, representing several schools in the region, were able to engage with peers from across the country and witness firsthand the workings of American democracy.